In the United Kingdom, the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day. It is the British Government's key interest rate for enacting monetary policy.[1] It is more analogous to the US discount rate than to the federal funds rate. The security for the lending can be any of a list of eligible securities (commonly gilts) and the transactions are overnight repurchase agreements. Changes are recommended by the Monetary Policy Committee and enacted by the Governor.

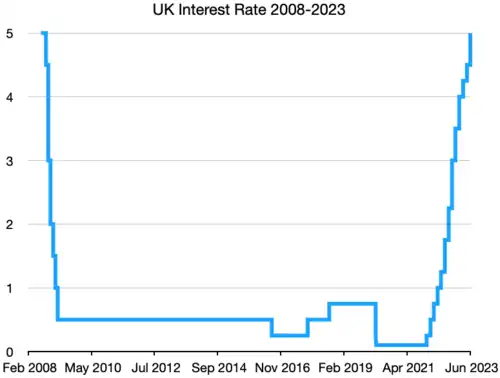

On 2 August 2018 the Bank of England base rate was increased to 0.75%,[2] but then cut to 0.25% on 11 March 2020,[3] and shortly thereafter to an all-time low of 0.1% on 19 March, as emergency measures during the COVID-19 pandemic.[4] It has since increased fourteen times to its current rate of 5.25% as of 03 August 2023.[5]

History

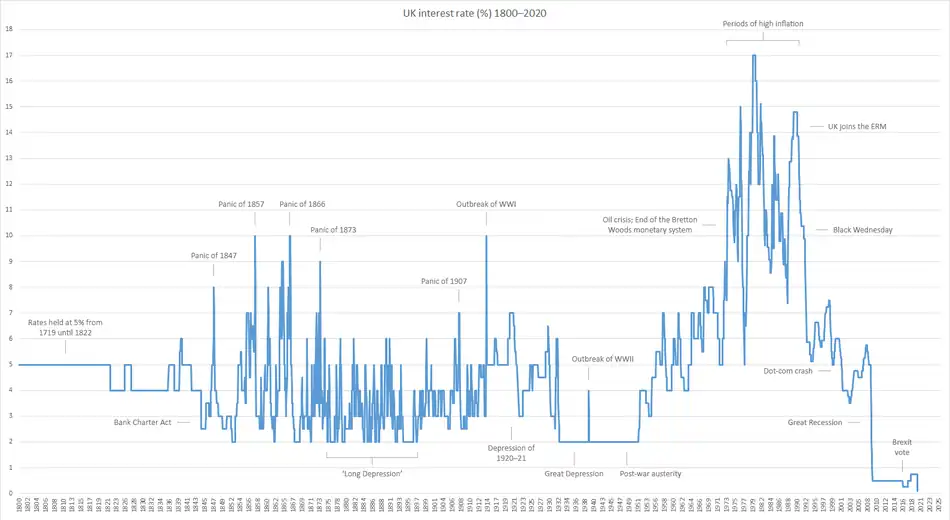

The official bank rate has existed in various forms since 1694 and has ranged from 0.1% to 17%.[6] The name and meaning (depositing vs lending) of this key interest rate has changed over the years. The current name, Official Bank Rate, was introduced in 2006[6] and replaced the previous Repo Rate (repo is short for repurchase agreement) in use since 1997. Previously (between 1981 and 1997) the name was Minimum Band 1 Dealing Rate and prior to that the Minimum Lending Rate.

See also

References

- ↑ "How Monetary Policy Works".

- ↑ "Interest & Exchange Rates | Official Bank Rate History". BankOfEngland.co.uk. Bank of England Statistical Interactive Database.

- ↑ "UK interest rates cut in emergency move". BBC News. 11 March 2020. Retrieved 13 March 2020.

- ↑ "Monetary Policy Summary for the special Monetary Policy Committee meeting on 19 March 2020". Bank of England. 19 March 2020. Retrieved 19 March 2020.

- ↑ "Bank of England raises interest rates by a half point to 5%". The Guardian. 22 June 2023. Retrieved 23 June 2023.

- 1 2 "Further details about wholesale - baserate data". Bank of England.